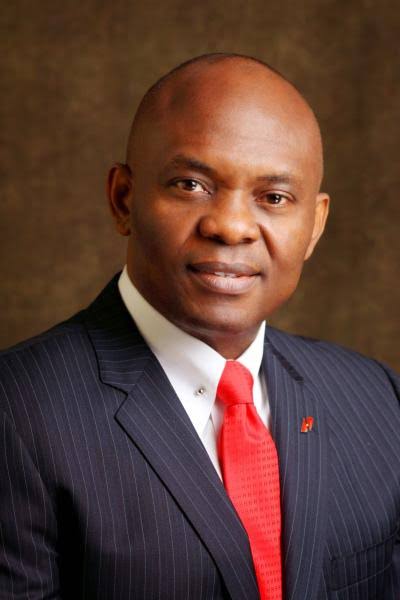

The Chairman of United Bank for Africa Group, Heirs Holdings Limited and TOE Foundation, Mr. Tony Elumelu has challenged the industry regulator to raise the capital requirement for insurance practitioners in the country.

He was speaking on Monday during the opening session of the National Insurance Conference organized by the sector regulator, National Insurance Commission holding at the Abuja Capital Hotel.

Against the background of the worrisome statistics of building collapse in the country over the last 49 years which has been put at an average of 11 cases per year, Elumelu lauded the Commission for their choice of theme, “Redefining Safety- Insurance Solutions for Public Buildings and Buildings under Construction.

To underscore the seriousness of the situation and aptness of the theme, he highlighted the high number of recorded building collapses which occurred in 2019, a total of 43 cases in just one year lamenting the loss of precious lives and property.

Exploring the theme, he said “Insurance should be as central to our construction industry as concrete that binds our buildings”

His speech was not just a compendium of challenges besetting the sector but was also laden with suggested solutions aimed at taking the sector higher.

He charged the regulators to be more focused on more important matters wondering why they would be interested or concerned about approving social media posts or adverts. He posited that NAICOM should work with insurance companies to run a continuous insurance campaign nationwide in local languages. All insurance companies, he added, should contribute a certain percentage of their profit towards the same cause.

Furthermore, Elumelu said the regulatory body must abandon old manual processes and embrace “less strenuous, less tedious and less difficult systems”.

He expressed concern that in spite of an abundance of youths in the country they are not attracted to the sector the way they are to other sectors stressing that it is important to make it snazzy and a lot more attractive to the young persons than currently obtains.

“We need a mind shift in the industry, we need a younger workforce”, said Elumelu.

Advocating an upward review of the capital requirement for the insurance companies, he said, “Today, capital requirement for the insurance sector are set at N8bn for life and N10bn for general insurance. With the devaluation of our currency, you are talking about 8m dollars for life and 10m dollars general, and this is an insurance company in Africa’s largest economy.” He wondered how such a poorly capitalized industry is supposed to play its role effectively.

He therefore recommended that capital requirement be increased to N20bn for life, N30bn for general and 1bn for insurance brokers.

He was quick to admit that it may not be a popular stance for which reason he exhorted that “as investors we should always think long term, in the long term a lot of good things happen”, while also alluding to how the Prof. Soludo recapitalsation of banks in 2005 helped to lift the capacity of Nigeria’s banking industry significantly.

He added also, to avoid any misconstruction of his recommendation, that the increase is not for gatekeeping or frustrating newcomers from entering the industry but for the purpose of building capacity to strengthen the sector.